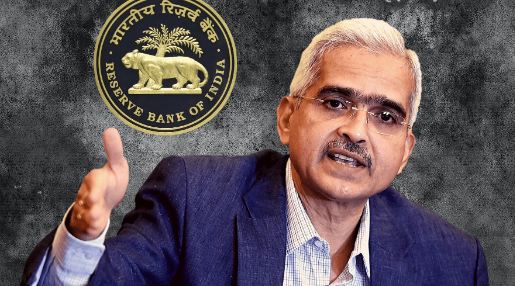

Loans will not be expensive, nor will you have to pay more EMI: RBI changed the interest rates for the 5th consecutive time, kept the repo rate at 6.5%.

RBI Governor Shaktikanta Das informed on Friday about the decisions taken in the Monetary Policy Committee (MPC) meeting going on since December 6, which is being held every two months. Reserve Bank of India Governor Shaktikanta Das held a meeting and informed about the decisions. In this decision, RBI said that the interest rates will not be changed for the 5th consecutive time, hence the interest rates have been kept the same at 6.5% i.e. the loans will not become expensive. EMI will also not increase, tell me that last

RBI had increased the rates by 0.25% to 6.5% in February 2023.

Earlier in the financial year, the repo rate was increased 6 times by 2.50%.

There are six members in this MPC meeting of RBI. It houses both external and RBI officials.

When the economy goes through a bad phase, there is a need to increase the money flow, in this way the RBI reduces the repo rate on which its commercial banks give loans at lower rates and in this way the money flow increases as in the Corona period. are done. During this period, there was a decrease in demand due to stagnation of economic activity, hence RBI increased the money flow in the economy by reducing interest rates.

Connection between repo rate and EMI.

Repo rate is the rate at which banks get loans from RBI and when the repo rate increases, taking loans becomes expensive.

When RBI reduces the repo rate, the bank reduces the interest rates.

RBI released inflation and GDP estimates.

Real GDP growth estimate in FY24 has been raised to 7% from 6.5%.

RBI kept the retail inflation estimate at 5.40% in FY24.

3 decisions of the Monetary Policy Committee.

RBI in India continues to work on creating some new cloud facilities to strengthen data security and privacy for the financial sector.

RBI has decided to increase the UPI transaction limit for hospital and education related payments from Rs 1 lakh per transaction to Rs 5 lakh.

RBI has also prepared the regulatory framework regarding loan products, web aggregation, along with this it has decided to establish a fintech depository, due to which more transparency has been maintained in giving digital loans.

Retail inflation at 6.83%.

Prices of vegetables decreased in October, due to which retail inflation came down to 4.87% in October. This was the lowest level of retail inflation in 5 months. Earlier in September it was 5.02% and inflation of food items was less than 6.62%. It has come down to 6.61%.

Wholesale inflation rate at 0.52%.

In the month of October, India's wholesale inflation rate came down to -0.52% due to decline in food items, before this in September the wholesale inflation was -0.26% but in August it remained at -0.52%. This was the seventh consecutive month that wholesale inflation remained below zero.

Inflation is affected.

Inflation is directly related to purchasing power. For example, if the inflation rate is 7%, then the value of Rs 100 earned will be only Rs 93. Therefore it is said that investment should always be done keeping in mind the true inflation otherwise the value of your money will reduce.

Comments

LEAVE A REPLY

Your email address will not be published